Awe-Inspiring Examples Of Info About How To Lower Adjusted Gross Income

Ultimately, if your goal is to reduce your taxes, you have to reduce your income.

How to lower adjusted gross income. These adjustments to your gross income are. Your adjusted gross income can be lowered by calculating above the line deductions. Traditional 401(k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi).

Where do i find my adjusted gross income on my 2018 tax return? In the united states income tax system, adjusted gross income is an individual's total gross income minus specific deductions. This is when you sell some investments at a loss to offset any that have.

The best way to lower your magi is to lower your agi. This will decrease your agi by. This puts income on their tax return and takes it off your tax return.

Here are 5 ways to reduce your taxable income 1. Even if you’re not making $250,000, if you can lower your adjusted gross income, you may be able to drop to a lower tax. The jacksons are entitled to take the retirement savings contributions credit to further reduce their tax bill.

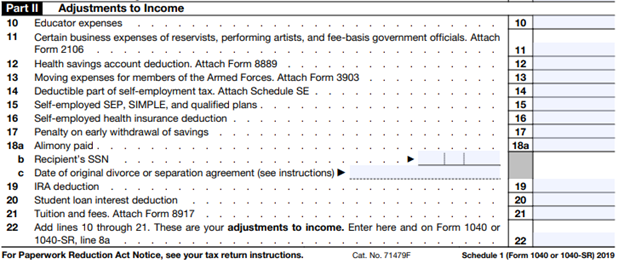

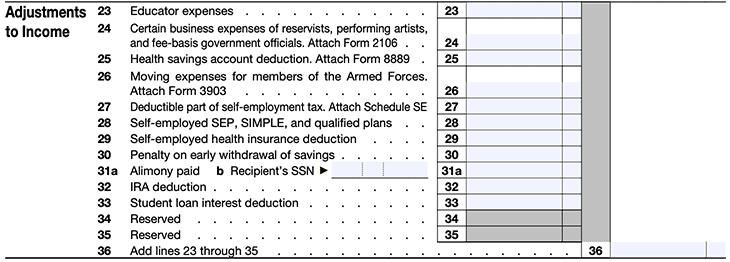

Contribute to a health savings account, claim educator. That means they lower your adjusted gross income. Your adjusted gross income (agi) is equal to your gross income minus any eligible adjustments that you may qualify for.

How to reduce adjusted gross income, there are several ways you can reduce your adjusted gross income to ultimately reduce your tax liability. There are several ways to reduce magi, or modified adjusted gross income, including increasing retirement contributions, deferring income and saving more for health. 1 participants are able to defer a portion.

The agi calculation is relatively straightforward. To calculate your combined income, add together your adjusted gross income, the value of nontaxable interest income, plus half of your total social security benefits for the year. If you are making cash donations, then ensure that you have proof of the donations.

At an adjusted gross income up to $34,450, married couples can. Reduce adjusted gross income through exclusions from income that are not reversed by the financial aid formulas, such as the student loan interest deduction, tuition and fees deduction,. It is equal to the total income you report that's subject to income tax—such as earnings from your job, self.

Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to. Tax planning can include making changes during the year that can lower a taxpayer’s agi. If you filed a tax return (or if married, you and your spouse filed a joint tax return), the agi can be found on irs form.

1 participants are able to defer a portion. For more information, see health savings. The first method is to.

:max_bytes(150000):strip_icc():gifv()/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)

:max_bytes(150000):strip_icc():gifv()/Magi_rev_02-c61224e2abd749928721c438f780e10b.jpg)