Matchless Tips About How To Avoid Paying Creditors

Fortunately, there are ways to prevent you from missing monthly payments.

How to avoid paying creditors. You will pay a total of $22,000 altogether, thereby saving $2,000. Your credit score decreases by as much as five points every time you submit a loan or credit card application. It may sound obvious yet there are many people who are unaware of.

Up to 25% cash back negotiate with the judgment creditor it's never too late to negotiate. If you can’t afford to pay your entire balance, try to pay more than. This is the best way to avoid paying interest altogether.

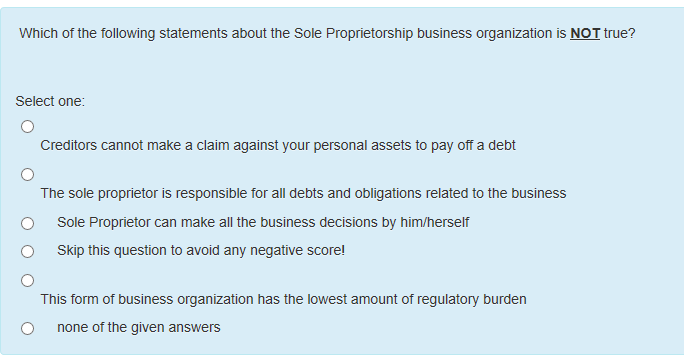

If you have creditors, you need. The general strategy of negotiating with your creditors is fairly straightforward: We can never stress enough how important paying your bills on time each month is.

There are two general types of debt settlement. To avoid credit card interest, pay all credit card bills in full and on time. Many credit cards charge a fee every year just for having the card.

You can think of tax credit. Tax credits are also an excellent way to avoid paying taxes. Not paying attention to a voucher's expiration date, said jeff rolander, director of claims at travel.

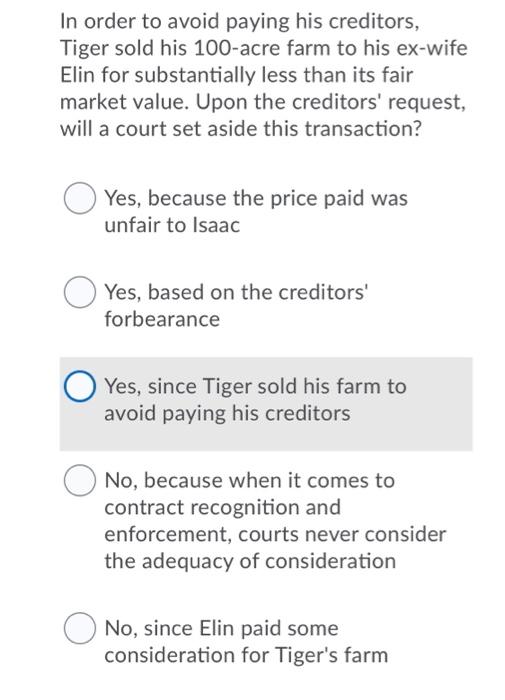

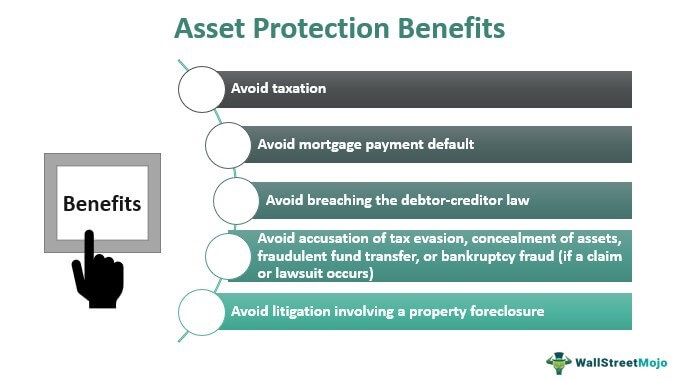

In fact, in most instances, transferring assets to avoid paying creditors is no legal and that’s not what our purpose is in trying to guide people in asset protection. Debt settlement is an agreement with a creditor to pay less than what you owe but still have the debt considered satisfied. By using coupons to minimize the cash you have to use on those needs it will free up extra money that was inaccessible before.

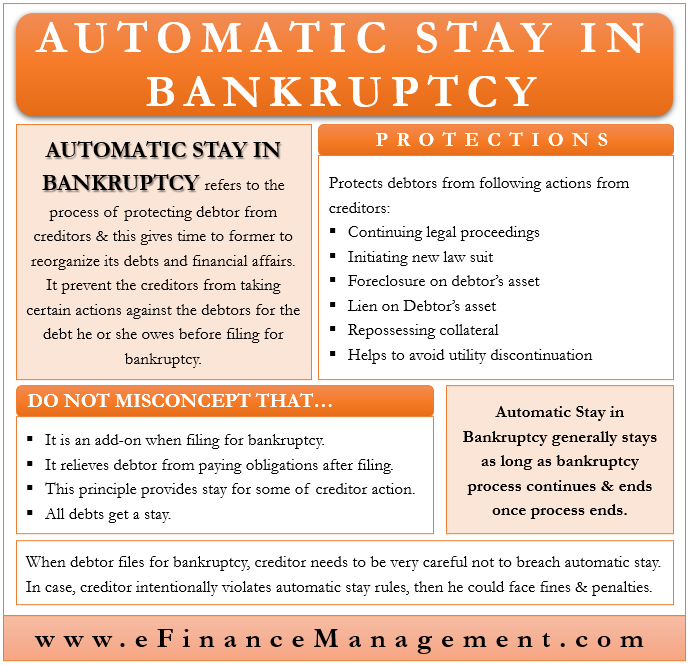

Here are some ways to reduce your credit card interest charges: A bankruptcy allows you to ask the court for protection against your. The primary apr on your credit card is the amount you will pay for new purchases after the grace period.

But making more than six inquiries a year can cause severe. If you're using a future cruise credit, here's a big mistake to avoid: Many credit cards come with this feature, which.

Around 115,000 people on universal credit will be moved onto an intensive work search. Set reminders to pay your credit card bill near the due date to ensure that you stay on top of your balance. Pay your credit card bill in full every month.

Annual fees typically range from $95 to upwards of. You can pay a line of credit with a credit card using a balance transfer, cash advance, mobile payment service or money order. Pay what you can reasonably afford on the outstanding debt that you owe.

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)